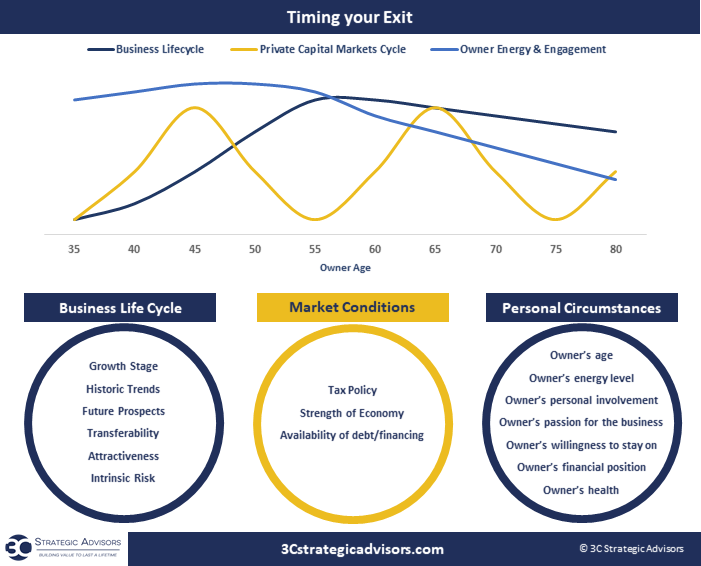

Is timing the market when planning to exit your business the path to success or an unrealistic expectation?

There are three primary factors relevant to timing an exit.

- Private Capital Market Conditions

- Business Life Cycle

- Personal Circumstances

PRIVATE CAPITAL MARKET CONDITIONS

Market conditions are almost entirely outside of your control as a business owner. Yet the state of the market is a significant contributor to the outcome of a sale or transition.

Private capital markets traditionally operate in cycles that fluctuate with the state of the underlying economy. If the economy is in an expansionary period, it is likely that businesses are performing well and there is more cash available for deployment and investment. This usually drives prices up.

When the economy is in a recession, private equity firms and businesses tend to avoid risk and take a more conservative approach. Privately held businesses generally pose more risk than their public counterparts, making them a less attractive investment during a downturn.

Financing guidelines and the availability of debt also contribute to the state of the capital markets. Cash-based deals are rare which means that business transitions are largely leveraged transactions. If banks aren’t lending freely, fewer transactions occur and prices are driven down.

Tax policy tends to get forgotten until a deal is in the works, but it has a significant impact on the outcome of a sale. When tax rates are low, sellers have an incentive to transition. Favorable tax rates mean real dollars saved. There can be a double-digit percentage difference in net proceeds strictly based on tax rates at the time of closing.

Economic conditions, tax policy and the availability of financing are all components of the private capital market.

Before you attempt to time the market, ask yourself: which of these are within your control?

BUSINESS LIFE CYCLE

Most businesses follow a natural life cycle. Early stage businesses tend to grow rapidly, but eventually that growth slows and begins to level out. As a business matures, it eventually starts to slowly decline unless strategic measures are taken.

Owners have some control over this cycle. New products or services can be introduced, or new markets entered, preserving the growth trajectory of the company.

Historical trends and future projections will also factor into the transferability and attractiveness of the company.

While some of these factors can be influenced by the owner, remember that to truly time the market, the business cycle must be aligned to the right market conditions.

Consider what will happen if a new competitor enters the market or a top customer leaves unexpectedly while you’re waiting for the perfect market condition.

Sometimes positive market conditions align with the height of the business cycle. However, even then it may not be enough.

PERSONAL CIRCUMSTANCES

Perhaps the most overlooked consideration is one’s personal circumstances. Waiting for the market and your business cycle to align may take years, during which time any number of things can happen in your personal life.

Let’s say you forecast your business to reach a pinnacle in 18-24 months which aligns perfectly with projected economic conditions. You fully believe you’re going to time your sale just right.

I would argue that it only takes one major health or life event to interrupt those plans. What were to happen if you had a heart attack 4 months later causing a complete disruption to your plans.

Health aside, there is a laundry list of circumstances in your life outside of the business that could completely change your outlook:

- Age

- Energy level

- Passion for the business

- Willingness to stay on after a sale

- Personal financial position and future needs

Attempting to time the market is ultimately a gamble, and one in which not many succeed. If you want to harvest the maximum amount of wealth, you need to focus on building real value today and every day.

Deploy a strategy with the goal to make every aspect of your business attractive to a potential buyer. Relentless execution of your strategy with this single aim will ensure you build a valuable, transferable and attractive business.

That’s exactly the type of business that will sell in good times or bad, making exit timing irrelevant.