The rapid spread of COVID-19 and resulting government mandates have put considerable strain on the small business community. Owners of thriving businesses have suddenly found themselves in survival mode with little to no revenue. The feeling of desperation in any situation can cause rash decision making let alone an unprecedented pandemic environment with no defined timeline or ending.

First, take a breath and know that you’re not alone. The courage, resourcefulness and determination that it takes to build a business is precisely what’s necessary to survive in difficult times. Having a solid handle on your cash flow is critical in any business cycle but is an absolute necessity during a challenging environment or economic downturn.

Follow this guide below to create a 13-week cash flow forecast for your small business.

STEP ONE: CASHFLOW PROJECTION

It is vital that you develop a 13-week (one quarter) cash flow projection. It will not only help guide you through the difficult decisions ahead but is also critical for accessing capital through loan or grant programs. Here are the basic steps for forecasting your cash:

- First project cash inflows (likely any remaining sales/revenue collections). You can do this as a single line item, or separate lines if you have multiple revenue streams.

- Next, project your weekly operating expenses or cash outflows. This should be done at the lowest level of detail possible.

- Subtract your cash outflows from your cash inflows to determine the net change in cash for each week.

- Finally, plug in your cash on hand and add/subtract to that amount the change in cash by week.

Hopefully you still reflect positive cash by the end of the 13th week. If you come up with a negative number in any given week, that’s your baseline for determining when you may run out of cash.

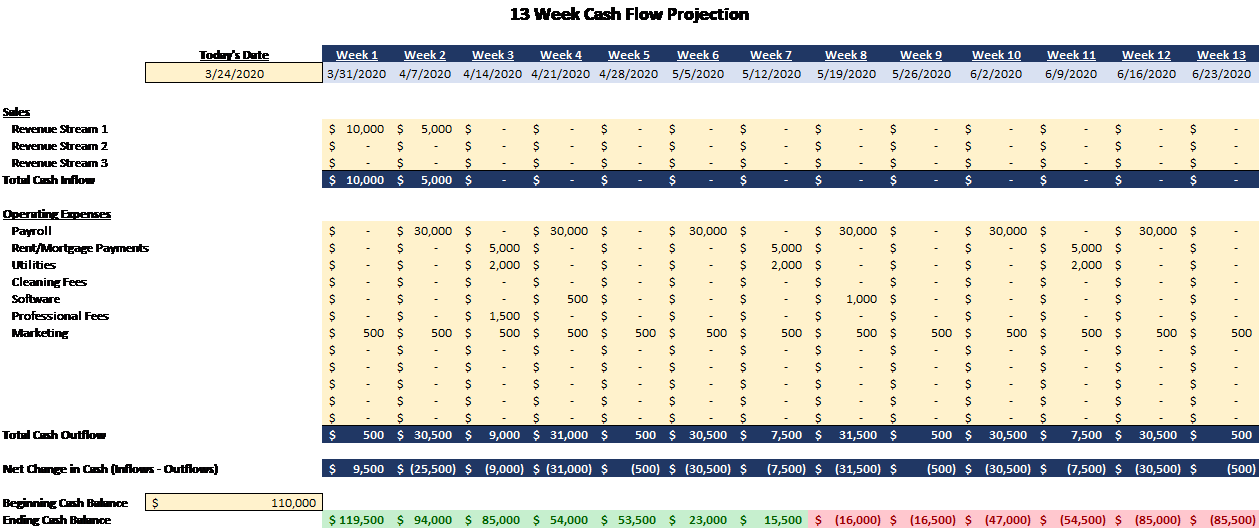

See below for an example. In this scenario, the business would run out of cash in the eighth week of operation without taking any interventions.

STEP TWO: COST CUTTING (CASHFLOW PRESERVATION)

If you project running out of cash or running too low on cash, you’re going to have to begin making difficult decisions. In the environment we’re in (an inability to boost revenue due to government mandates) this will likely come down to cost cutting and access to capital.

Go through your cash outflows line-by-line and determine where you can reduce, eliminate or defer costs. Here are a few examples of what to consider:

- Contact your lenders or landlord (if applicable) and inquire about assistance programs. They’re in business too and would often prefer to temporarily defer or reduce payments in order to avoid long-term defaults or bankrupt clients.

- Get in touch with vendors and attempt to negotiate reduced or deferred terms.

- Pause on discretionary and/or unnecessary expenses. If you can’t operate, you may want to consider temporarily reducing your marketing expense.

STEP THREE: CAPITAL INFUSION

If this still isn’t enough, you’re going to have to boost your cash inflows. Consider ways to access capital.

- The SBA has a special disaster relief program in place right now for small businesses due to COVID-19. Check out more information here: https://www.sba.gov/page/coronavirus-covid-19-small-business-guidance-loan-resources

- Facebook recently announced grants for small businesses to help them survive in the current environment. Check out the program at: https://www.facebook.com/business/boost/grants

- Inquire with your local state and county small business associations for programs being developed in your area

- The CARES Act geared towards providing relief through the current pandemic just passed. Explore ways in which the act can assist your specific situation by visiting the U.S. Department of Treasury at https://home.treasury.gov/policy-issues/top-priorities/cares-act/assistance-for-small-businesses

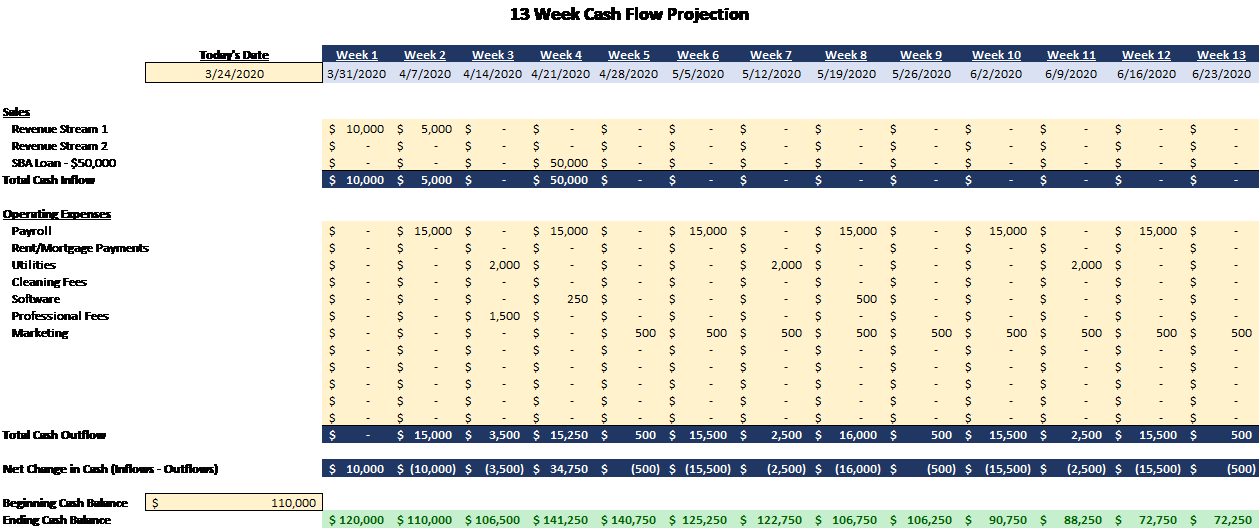

Here’s a look at an adjusted cash flow projection for the same sample business mentioned earlier that took some of these actions. By taking calculated measures and seeking relief through a $50k SBA loan, their cash flow is no longer negative in week 8 and is viable through the next 13 weeks.

BUSINESS INTERRUPTION INSURANCE

Most small businesses carry various forms of business insurance. Some of these policies include business interruption coverage, although it may be limited in scope.

Get in touch with your broker and have your policies reviewed as soon as possible so that you can keep proper records of loss, promptly notify your carrier, and prepare to pursue coverage if applicable.

IN CLOSING

While a robust cash flow forecast and cash management system is critical in challenging times, we suggest implementing such a process in any time. Once the current pandemic has ended, and it will end, businesses should be focused on recovery and growth. A cash management process is just one way you can help maximize the value of your business.

3C Strategic Advisors is a financial and strategic advisory firm located in Phoenix, Arizona. We help businesses and their owners develop strategies to propel their growth and increase the value of their companies.

And we aren’t just business advisors. We have private wealth managers that can also help prepare your financial plan and align it with your business aspirations and personal goals to ensure all three aspects of your life are in constant alignment.